Giving act

The Holland Festival has a cultural ANBI status, which means that your gift is 125% deductible from your taxable income.

You can add up the total of several donations to cultural institutions that are registered charities. A maximum donation amount of € 5,000 in total per year applies to the 125% rule. If you donate more than €5,000 to registered charities, you can deduct the remaining amount for the regular percentage of 100%. The benefits of the Giving Act apply to all taxpayers in the Netherlands (individuals and companies) and apply to both one-time and regular donations.

One-time-donations

One-time donations are tax deductible if the total amount given in one year exceeds the so called threshold amount, 1% of your income, with a minimum of €60. The amount above the minimum threshold is tax deductible. The maximum deductible amount is limited to 10% of your taxable income. It is possible to add up several one-off donations to different ANBIs to arrive at between 1% and 10%.

Recurring gifts

Recurring gifts are fully deductible from taxable income and have no thresholds or limits. A recurrring donation consists of a fixed amount per year for at least five years. To make a recurrring donation, please complete both copies of the form 'Recurring Gift Agreement' and send both copies to Holland Festival. We will return one copy for your records.

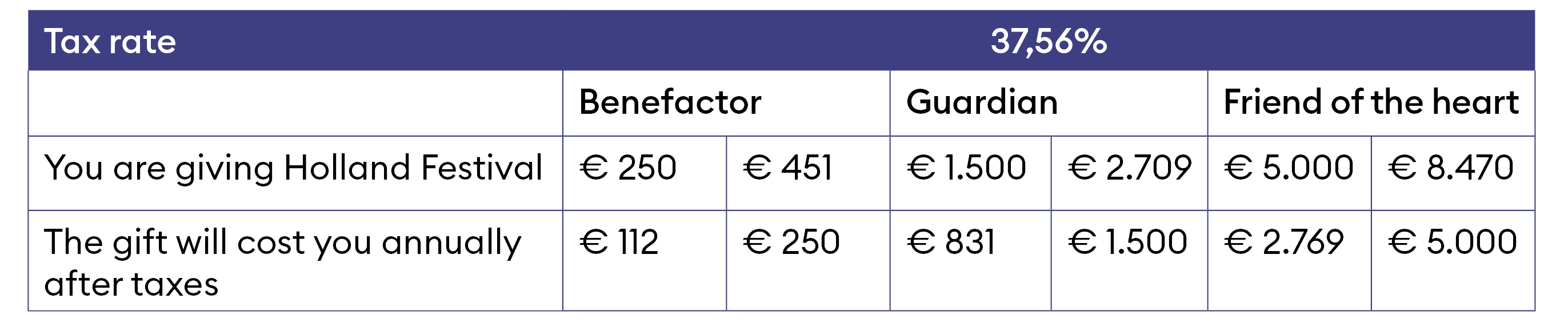

In the example below, you can see the benefit of a recurrring donation. The benefit has been calculated on the left in the Benefactor and Guardian columns. You can also choose to keep your net donation the same. You will then see on the right-hand side what the donation will cost you before tax benefits. The column Friend of the heart' shows the maximum benefit that appliesto your gift under the Giving Act. This gift of € 5,000 is the maximum that you can deduct from your taxable income with the multiplier of 25%. In our online calculator you can calculate which tax advantages apply in your specific situation.

The tax benefit from the deduction of donations will be a maximum of 37.56% in 2026. Even if you have a higher income and pay 49.5% on your income in box 1.

We will gladly inform you about the possibilities.

Contact:

Mathilde Smit, development director

tel. +31(0)20 - 788 2118

email [email protected]